It was sometime around 2017 or 2018 that I got a random friend request on Facebook. That’s nothing out of the ordinary but I was soon greeted with texts from the guy. Once we got to know each other a bit, a lucrative offer was placed on the imaginary table in front of me. He said that every month I would get an “X” amount of money if I invest “Y” amount of money right now and can make more if I get more people into this. Now, I know where this was going but I didn’t reject the offer- not yet. The following days, he kept texting me to convince me, going as far as showering me with compliments. His efforts went in vain as I soon rejected him. I was absolutely shattered when he (who is quite a famous “influencer” now) unfriended me after realizing this is going nowhere. That was when I for the first time, without much effort, fended off a Pyramid Scheme.

What Is A Pyramid Scheme?

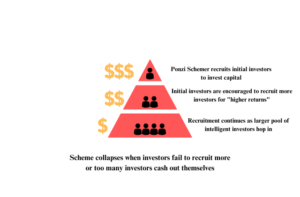

A Pyramid Scheme is an investment fraud where money from newer investors are used to pay the promised returns to earlier investors. Allow me to explain it to you with the help of a diagram:

It’s awfully easy to spot a pyramid scheme. Just take a look at how Jim Halpert from The Office does it:

The Signs Of A Pyramid Scheme

- High returns with little to no risk

- Consistent returns

- No sign of being registered under or monitored by a government financial body

- Questionable paperwork (If there actually is any)

- Relentlessly being pursued and incentivized to recruit investors

- Withdrawing money seems to be a chore

Diving Not So Deep Into MTFE

If you’ve been following national news lately, you must have heard of MTFE- a similar pyramid scheme that has made away with possibly hundreds of crores of Bangladeshi Taka. MTFE or Metaverse Foreign Exchange Group (the entire name is a red flag lol) branded itself as a Shariah-compliant trading platform that promised insanely high returns on investments. Although no official data has been released, thousands of Bangladeshis have invested in it. The pitch was simple- you invest capital, we have experts who will make you money off that capital. In reality, there really was no market to begin with. The entire platform was unregulated but users still poured in.

On August 17, the accounts of every user froze showing negative balances. Colossal gains turned into massive losses as users failed to cash out. Despite all that, several unidentified agents threatened users to invest afresh resorting to intimidation and threats. In order to make up for losses, many were forced to refer new users who also got caught in the spider’s web.

I can’t help but think who’s really responsible for this. The perpetrators behind MTFE themselves? The lack of accountability of governmental and concerned authorities? Or just our negligence of financial literacy? Food for thought if you ask me.

Looking For Proper Investment Opportunities?

Now, I ain’t no finance guru but I’ve dabbled around multiple investment opportunities post-pandemic. Starting from stocks to in-game items, the trading and investments journey so far has been pretty fun. In my opinion, here are a few safe investment opportunities for you if you’re thinking of getting started with investments:

iFarmer

iFarmer is a startup that empowers farmers and agricultural entrepreneurs by providing capital and necessary resources to boost production. Here, you can fund farms and at the end of the harvest, you receive a percentage of the profit along with the capital that you invested. There are Shariah compliant farms available on the platform as well.

I personally have been a huge fan of iFarmer since the pandemic and it has been a pleasure to witness them grow to the top of agri-tech in Bangladesh. It’s a solid option to invest in if you just want to click a few buttons and lay back.

GoldKinen

It’s exactly what the name suggests. You can quite literally buy Gold (22 karat) sitting at home thanks to GoldKinen. Prices start for as little as 500 Taka and it only goes up from there. You can not only buy gold from here but also sell on the same platform to other users. Gold Kinen holds a gold dealing license under the Gold (Procurement, Storage, and Distribution) Order, 1987, which allows the company to deal in gold products across Bangladesh. On top of that, they have partnerships with companies such as bKash, Securex, BRAC Bank and Green Delta Insurance.

Gold is a solid investment in Bangladesh as the price of Gold has increased over 80% in the last 5 years alone. I am actually considering trying this out and will be keeping my eye on this.

Stock Market

Now this one might be a bit on the controversial side thanks to the average Kamrul’s (uncalled for) hate on stocks. Sure the domestic stock market is a lot shakier than most others but the risk is decreased by a fair bit if you invest using only your disposable income. That’s what I did and I’m doing fine for someone who’s still learning the ropes of stock trading. However, one must note that in Bangladesh, it’s little tedious to get your hands on authentic stock market dataset. Also, the overall trading experience isn’t that seamless to be honest.

To get started with stocks, you have to open a B/O account with a brokerage of your choice, deposit money and then you can start trading. This process shouldn’t take more than a week’s worth of business days. My brokerage of choice is IDLC and my trading journey so far on their platform has been pretty satisfactory.

I am gonna say this again: I am by no means a “finance guru” but part of the reason why this blog exists is because I am here to share some of my experiences. You are more than welcome to disagree or add your own opinion via comments, I look forward to them. Until next time, invest wisely, my friends!

You not only explained the scam very nicely, you also provided legit alternatives which i was pleasantly surprised by. Thanks!